Climate Change Initiatives(TCFD)

Endorsement of TCFD Recommendations

The PARK24 GROUP (“the Group”) views climate change as one of the most important management issues for the early realization of a decarbonized society.

The Group has endorsed the recommendations of Task Force on Climate-related Financial Disclosures (TCFD) in December 2021. The Group’s disclosure is in line with the TCFD's recommended disclosure framework (“Governance”, “Strategy”, “Risk management”, and “Metrics and targets” related to climate change risks and opportunities).

Going forward, we will further strengthen our governance and business strategies related to climate change based on the results of our scenario analysis, as well as expand and enhance our information disclosure.

Information disclosure based on TCFD recommendations

Governance

Governance Structure

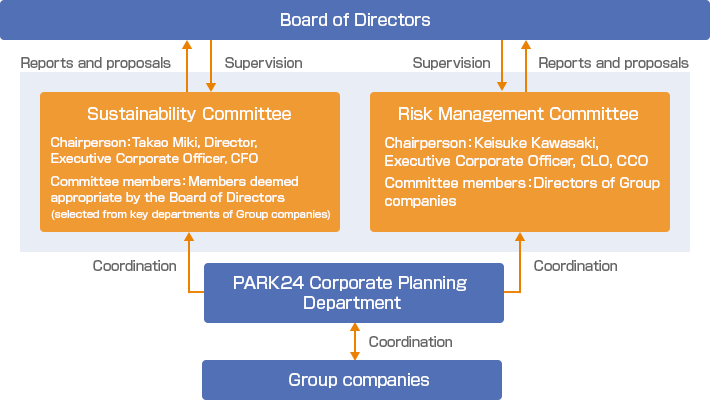

The Group supervises response policies, targets and progress related to environmental and social risk and opportunities including climate change on a regular basis through the Board of Directors. Additionally, business risks including climate change are chiefly supervised by the Risk Management Committee as a part of the Group's risk management efforts.

The Sustainability Committee formulates sustainability policies and strategies aimed at solving environmental and social issues, deliberates over and determines the metrics to be adopted as targets, and carries out initiatives that span the Group. The committee reports on its progress and delivers recommendations to the Board of Directors as appropriate. The committee is chaired by a director or executive corporate officer and its members comprise those deemed appropriate by the Board of Directors in light of its purpose.

The Risk Management Committee comprises the Representative Director and the directors of Group companies as a company-wide risk management structure. With the Representative Director serving as the Chief Risk Management Officer, the committee identifies and assesses risks, pursues activities to avoid or minimize the impacts of these risks in advance, and delivers regular reports and recommendations under the supervision of the Board of Directors.

PARK24’s Corporate Planning Department is primarily responsible for climate-related targets and their progress, which it promotes by coordinating between the Sustainability Committee, Risk Management Committee and Group companies.

Introduction of ESG Metrics into Directors' Compensation

To achieve its medium-to-long-term vision and attain sustainable business growth, the Group recognizes the need to align with shareholders and other stakeholders and develop a more rational and transparent compensation system.

To that end, as permanent long-term incentives the Group has introduced a restricted stock compensation system and incorporated ESG assessment metrics for the system. We believe that doing so will enable us to carry out sustainability related initiatives with greater vigor.

- 1) Basic compensation is determined based on a compensation table that takes into account the director’s duties, roles, responsibilities, and the scale of business profit, among other factors.

- 2) Short-term incentive (STI) is calculated by multiplying the base amount set for each position by a factor corresponding to the achievement rate of evaluation indicators—namely, consolidated operating profit and consolidated net income. Consolidated operating profit is used as an indicator because it reflects profit from core business operations, unaffected by exchange rates or interest rates, and is therefore suitable for evaluating contributions to core business performance. Consolidated net income is selected as it directly reflects final profit and is thus appropriate for evaluating contributions to shareholder value. In addition to these quantitative indicators, qualitative indicators are also used to assess directors’ performance based on their respective roles.

- 3) For long-term incentive (LTI), we have introduced a restricted stock compensation system. The restriction period is set to last until immediately after retirement from a position predetermined by the Board of Directors among those held at the Company or its subsidiaries. Given the nature of LTI as a reward for efforts to enhance long-term corporate value, the evaluation indicators include not only contributions to overall corporate profit—such as consolidated operating profit and consolidated net income—but also capital efficiency (ROIC), ESG indicators, and qualitative assessments. The ESG indicators are structured from the perspectives of environment, society, and governance. From an environmental standpoint, the degree of achievement of medium- to long-term sustainability targets is evaluated. In terms of social factors, the employee engagement index is used to assess organizational health and workforce motivation. For governance, the evaluation is based on ESG-related scores provided by external rating agencies.

Strategy - Preconditions and Scenario Setting

Specifying the Scope of Businesses and Fiscal Years to be Analyzed

Analysis was performed on the Parking Business Japan and Mobility Business, which accounts for the majority of operating profit in the Group. In addition, the year 2050 was designated as the fiscal year for analysis.

Risk Severity Assessment

The impact of future climate change on the Group's business was identified with reference to climate change reports and other materials from outside organizations in terms of the risks and opportunities of the shift to a decarbonized society (policy and regulations, industry and markets, technology), and in terms of the physical risks and opportunities attributable to climate change (chronic and acute). Then the major risk and opportunity items expected to be highly associated with the analyzed businesses were identified.

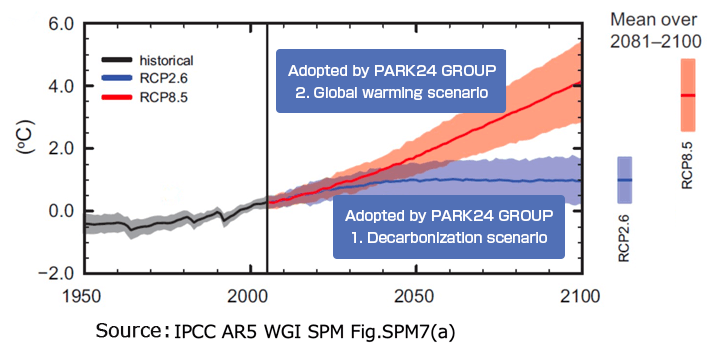

Setting Scenarios and Parameters

For scenarios, we referenced reports and other materials about future predictions issued by the IPCC, IEA and other governmental and international organizations, and adopted two scenarios, 1. decarbonization scenario (1.5ºC - 2ºC scenario) and 2. global warming scenario (2.7ºC - 4ºC scenario).

Global average surface temperature change

Decarbonization Scenario (1.5ºC - 2ºC scenario)

A world in which the average rise in temperatures is kept below 2ºC up to the end of the 21st century

Scenario in which regulations and policies aimed at decarbonization are strengthened and progress is made with action on climate change to keep the rise in temperatures compared with pre-industrial levels to 1.5ºC - 2ºC. Under this scenario, it is predicted that customers' preferences for products and services will change, companies will face strong pressure to respond to climate change, and if companies do not adapt, their transitional risks will increase, including an outflow of customers and increased reputational risk. However, it is predicted that the physical risks would be relatively low due to the increasing severity and frequently of climate-related disasters being kept to a certain level.

Global Warming Scenario (2.7ºC - 4ºC scenario)

A world in which the average rise in temperatures increases to 4ºC by the end of the 21st century

Scenario in which sufficient climate change action is not implemented, and average temperatures rise to around 4ºC from pre-industrial levels. Under this scenario, physical risks are predicted to rise, including increasingly severe natural disasters, rising sea levels and an increase in abnormal weather events. It is believed that this will increase the competitiveness of products and services that offer superior BCP performance. However, there is predicted to be low transitional risks, due to governments not enacting stricter regulations, etc.

- IPCC Fifth Assessment Report

- UNEP The Emissions Gap Report 2015

- IPCC Global Warming of 1.5°C

- IEA Energy Technology Perspectives 2017

- IEA World Energy Outlook

- Ministry of Land, Infrastructure, Transport and Tourism "Manual for Economic Evaluation of Flood Control Investment" (April 2020)

- Technical Committee of Flood Management Plan Considering Climate Change "Planning Approach of Flood Management Considering Climate Change - Recommendations" (2019)

Report sources used to set scenarios and parameters

Strategy - Scenario Analysis Results(1)

1. Decarbonization Scenario

Summary

In the decarbonization scenario, the electric vehicle (EV) target declared by the Japanese government is relatively higher than the global warming scenario, and it is expected that adoption costs associated with vehicles will increase as EV-related costs in accordance with this target.

In addition, the use of non-EV vehicles that comply with the government targets is expected to decline. This risk can be minimized by replacing vehicles at an early stage, and we believe that this will enable us to maintain our competitiveness in the market while earning the trust of customers. For physical risks, abnormal weather is expected to become more severe than it is now, but since the impact is expected to be lessened to a certain degree and measures are being implemented to minimize the risks compared with the global warming scenario, even if a disaster were to occur, it is assumed that the expected monetary impact from damages would be insignificant.

As for opportunities, the costs associated with operating mobility vehicles (equivalent to current fuel expenses) will decrease and it is also assumed that with the development of EV chargers, sales will increase by rolling out services as an electricity supplier.

*

Electric vehicles (EVs)

For the purpose of this report, an EV refers to a Battery Electric Vehicle (BEV). In the environment surrounding the Company, we anticipate that it will be especially important to adapt to BEVs in the future.

2. Global Warming Scenario

Summary

In the global warming scenario, it is assumed that the costs of adapting to government EV targets would increase to a certain extent because technologies related to zero greenhouse gas emissions will not spread as widely as the decarbonization scenario, and cost reductions are not expected.

Physical risks are also expected to rise in this scenario. While the monetary costs due to damage from natural disasters (flooding, etc.) would be minor, they would be greater than in the decarbonization scenario, but as with the decarbonization scenario, the expected monetary costs of damage are expected to be insignificant.

As for opportunities, compared with the decarbonization scenario, it is assumed that government policies and regulations will not be made stricter, and that the costs of adapting to transition risks will be relatively lower.

Strategy - Scenario Analysis Results(2)

Assessment of the Degree of Impact by Business

| Business | Type | Category | Subcategory | Summary of Impact (Risks and Opportunities) |

Occurrence Timing | Impact | |

|---|---|---|---|---|---|---|---|

| Decarbonization | Global Warming | ||||||

| Parking | Transition | Technology | Advancement of Next-generation Technologies | With the widespread adoption of EVs it will be necessary to set up charging equipment at parking facilities, and capital investment costs will increase. | Medium-to-Long Term | Large | Moderate |

| With the development of EV chargers, sales will increase by rolling out services as an electricity supplier. | Medium-to-Long Term | Large | Moderate | ||||

| Physical | Acute | Increasingly severe abnormal weather events | If damage occurs, sales will decrease due to fewer operating days and a decline in users. | Medium-to-Long Term | Small | Moderate | |

| If physical damage occurs, the Company will bear the entire cost of restoring parking facilities. | Medium-to-Long Term | Small | Moderate | ||||

| Mobility | Transition | Policies and Regulations | Tax liability due to the introduction of a carbon tax | If a carbon tax is introduced, it is expected that carbon taxes will be incurred to operate the business, increasing operational costs. | Medium-to-Long Term | Small | Small |

| Industries and Markets | Changes to energy demand, etc. | Due to the sharp rise in fuel prices, the operational costs for mobility services will increase. | Medium-to-Long Term | Large | Large | ||

| Changes in customers and markets | Due to a changing external environment or increased consumer awareness, vehicle investment associated with EV adoption will be incurred. | Medium-to-Long Term | Large | Large | |||

| Technology | Advancement of Next-generation Technologies | Due to the widespread popularity and expansion of EVs, the Company will be required to shift to EVs, incurring management costs unique to EVs. | Medium-to-Long Term | Moderate | Small | ||

| Physical | Acute | Increasingly severe abnormal weather events | If damage occurs, sales will decrease due to fewer operating days and a decline in users. | Medium-to-Long Term | Small | Small | |

| Costs will be incurred to repair or re-purchase vehicles due to the flooding of vehicle assets. | Medium-to-Long Term | Moderate | Moderate | ||||

Strategies and Initiatives in Light of the Scenario Analysis

In December 2021, the Group announced medium-to-long-term sustainability goals. The targets also encompass goals related to climate change (the environment), and initiatives will be implemented based on these goals. Based on the results of this risk assessment and business impact assessment, we will promote initiatives to avoid or mitigate the risks, and consider active business expansion to take advantage of opportunities, with the aim of enhancing our strategic resilience in each business.

In the Parking Business, we will keep close watch on trends concerning the widespread adoption of EVs and promote the installation of EV chargers at our parking facilities. When doing so, we will consider the possibilities of utilizing subsidies related to charging infrastructure and collaborating with related companies. Additionally, in relation to physical risks, we will work to minimize damage and speed up recovery at parking facilities by making them more lightly equipped (e.g., flapless).

In the Mobility Business, we will keep close watch on trends concerning the widespread adoption of EVs and promote the adoption of EVs for our mobility services. When introducing EVs, we will consider options such as the utilization of EV-related subsidies. For risks related to changing energy demand and similar developments, we will consider procuring renewable energy-based electricity and renewable energy certificates.

For the increasing severity of abnormal weather events, which is a physical risk that is common to the Parking Business and Mobility Business, we will pursue improved BCP aimed at early recovery for both businesses.

Risk Management

Risk Management System

The Group has established a Risk Management Committee chaired by the head of the legal and compliance division appointed by the Board of Directors. The committee's members are made up of the officers and employees of Group companies. The Risk Management Committee creates a risk map that lists the risks that could impact Group management including climate change-related issues, monitors important risks, and periodically adds, modifies, assesses and reviews the identified risks. The results of these activities are reported to the Board of Directors quarterly, in order to deal with risks and prevent them from materializing.

By preventing or reducing losses from risks that have an impact on Group management, and by minimizing the impact when risks materialize, the committee plays an important role in ensuring ongoing business stability and improving corporate value.

Climate-related Risks

To deal with climate risks, the Risk Management Committee, Sustainability Committee and PARK24 Corporate Planning Department work together to formulate various policies and strategies for minimizing risks and seizing opportunities. A management system to monitor these initiatives has also been put in place.

The Risk Management Committee also plays a leading role in periodically reviewing climate-related risks and opportunities.

In terms of specific risk management measures, by monitoring the achievement status of medium-to-long-term sustainability goals with the Group's materialities as a guide, we help enhance the Group's risk management structure in relation to sustainability, including climate change.

Metrics and Targets

Setting Metrics and Targets

To coincide with the identification of the materialities of the PARK24 GROUP in December 2021, the Group set medium-to-long-term sustainability targets.

Among these, goals related to climate change (the environment) are as follows.

| Materiality | Theme | Medium-to-Long-Term Targets or Policies for 2030 |

|---|---|---|

| Contributing to a sustainable global environment | Contribution to Reducing Greenhouse Gas Emissions |

|

| Effective use of resources |

|

Greenhouse gas emissions

PARK24 GROUP calculates GHG emissions for Scope 1, 2, and 3 of our domestic businesses based on the GHG Protocol in order to understand the overall environmental impact of its business activities, including the value chain.

← Scrollable →

(tCO2)

| Category | Main CO2 emissions | FY2022 | FY2023 | FY2024 |

|---|---|---|---|---|

| Total for Scope1+2+3 | — | — | 438,786 | 516,672 |

| Scope1 | Gasoline consumption for sales, management, maintenance, and fleet | 174,778 | 200,435 | 233,852 |

| Scope2 | Power consumption at parking facilities and business sites | 33,438 | 36,387 | 33,692 |

| Scope3 | Indirect emissions from the supply chain and other sources | — | 201,965 | 249,128 |

- * The calculation for Scope 1 primarily includes gasoline consumption by Times CAR vehicles (including fuel consumption not covered by our company in the rental car.).

- * The calculation for Scope 2 primarily includes electricity consumption by offices, Times PARKING, and Times CAR rental locations.

- * For details on the calculation of Scope 1–3 emissions, please refer to the "Sustainability Related Data" section.

Future Initiatives to Respond to the TCFD Recommendations

On this occasion we conducted a scenario analysis covering our domestic businesses. The analysis showed that while we cover a certain degree of resilience against future physical risks, we need to pay more careful attention to transition risks including energy trends and trends in EV uptake. Going forward, the Group will work out where its opportunities lie while pursuing analyses in greater depth, and explore initiatives to mitigate and avoid risks. We will also expand the businesses covered in our analyses, pursue the quantitative monitoring of risks and opportunities, and reflect those findings in medium- and long-term planning to achieve a sustainable global environment and society through growth in the Parking Business and Mobility Business, in keeping with our Group philosophy of "creating new forms of comfort and convenience by responding to the needs of today and anticipating the needs of tomorrow."