Risk Management

Basic Approach to Risk Management

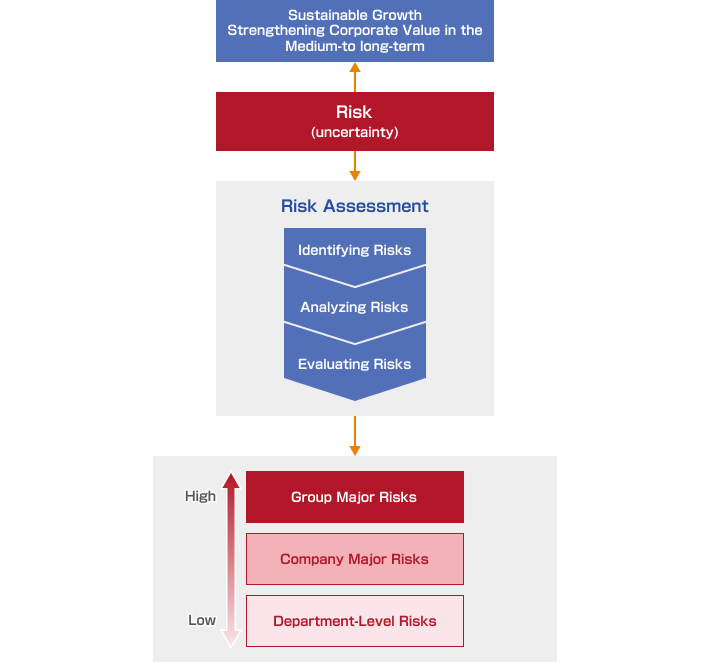

PARK24 GROUP defines risk as “uncertainty that may affect the achievement of our goal of sustainable growth and the enhancement of medium- to long‑term corporate value.” Based on this definition, we effectively engage in risk‑taking, which involves accepting factors that may promote the achievement of our objectives, and risk‑hedging, which involves addressing factors that may hinder them. In addition, through continuous monitoring and review of these activities, we implement comprehensive Enterprise Risk Management (ERM) across the entire Group.

Risk Management Framework

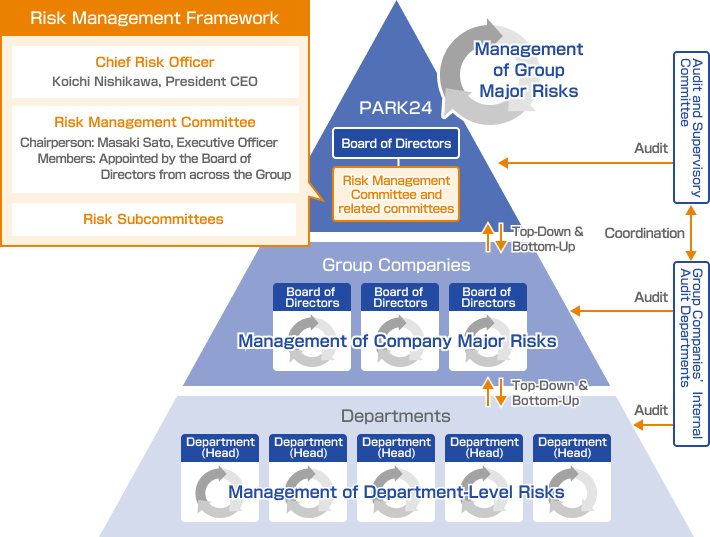

Our Group’s risk management framework designates the President and CEO as the Chief Risk Officer. In addition, we have established the Risk Management Committee as the body responsible for promoting Enterprise Risk Management (ERM) across the entire Group.

The Risk Management Committee is chaired by the Executive Officer overseeing the Legal & Compliance Department. The Committee conducts a comprehensive assessment of Group-wide risks. It directly manages major risks that may significantly impact the entire Group, while overseeing the risk management activities carried out by each Group company and business unit with respect to non-major risks. Through this approach, we aim to maintain a structured and integrated risk management framework.

Furthermore, under the Risk Management Committee, we have established several Risk Subcommittees. These cross-functional bodies coordinate risks that span multiple departments or Group companies, and are responsible for managing Group-level major risks, assessing emerging risks, and implementing related initiatives.

Risk Management Process

Our Group’s risk management process is based on the Risk Management and Crisis Management Rules (the “Rules”), and is fundamentally carried out annually by each department in accordance with the business year.

Risks are assigned managers according to the risk levels determined through risk assessments. Risks that may affect the entire Group are designated as Major Risks and are managed by the Risk Management Committee. Risks that have higher priority within each Group company are designated as Company Major Risks, and are overseen by the Board of Directors of each respective company. For each risk, the responsible risk owner (the department in charge) conducts regular monitoring and review of the status of risk responses.

In addition, emerging risks—those newly arising or surfacing during the business year due to internal or external environmental changes—are subject to periodic risk assessments. When necessary, relevant departments are consulted and reports are made, and appropriate countermeasures are implemented.

While some overseas Group companies have established their own rules that differ from the Rules described above, they maintain risk management practices consistent with the standards set by these Rules.

Group Major Risks

Our Group identifies risks that may have a significant impact on the entire PARK24 Group as Group Major Risks.

Details of these major risks are disclosed in the “Business and Other Risks” section of our Annual Securities Report.